Inflation in the US might flatten out; what can oil do for renewable?

The US CPI figure in December released on Wednesday, January 12, showed that the inflation rate in the US now appears to have plateaued at a 7% annual rate. The market took the figure with a sigh of relief, and the US 10-year Treasury yields rose marginally last week from 1.77 to 1.79 percent.

In this weekly trading note from Carlsquare, we elaborate on the following topics, indices, and stocks:

- Gold, a typical buy during times of inflation

- Weakened USD with big rate gap

- Is there enough energy left for oil to break up?

- Do rising oil prices ease economical calculations for sustainable energy?

- Excellent rebound in S&P 500

- Nasdaq’s rising trend is under pressure

- Downside left in Microsoft

- Historical Schiller P/E-ratio valuation in the light of inflation

- OMXS30 below MA20

- DAX is still holding up

Inflation in the US might flatten out; what can oil do for renewable?

The US CPI figure in December released on Wednesday, January 12, showed that the inflation rate in the US now appears to have plateaued at a 7% annual rate. The market took the figure with a sigh of relief, and the US 10-year Treasury yields rose marginally last week from 1.77 to 1.79 percent.

But the rise in commodity and input prices is broad, and one of the things that US companies frequently mention in their conference calls after the Q4 reports. But they also note rising freight and transportation costs, disruptions in supply chains, and, most of all, the risk of increasing payroll costs for staff due to recruitment challenges. Inflation will probably dampen corporate profits from now on to an increasing extent.

Gold, a typical buy during times of inflation

We saw rising interest rates and inflation; the last was 2008-2010. Investors have turned to value stocks during such periods instead of growth stocks. Investments in gold, silver, and energy also tend to do well during such periods.

Below is the gold price that turned lower on Thursday, January 13, after a strong start of the previous week. The 1830-level seems challenging to break even though inflation is persistent and the USD is weakening. Does that mean that we will see the next move be downwards?

Gold: June 15, 2021, to January 14, 2022

In the weekly chart, gold is trading in a neutral wedge formation. Note how momentum is rising visualized by MACD.

Gold, weekly five-year price graph

Weakened USD with big rate gap

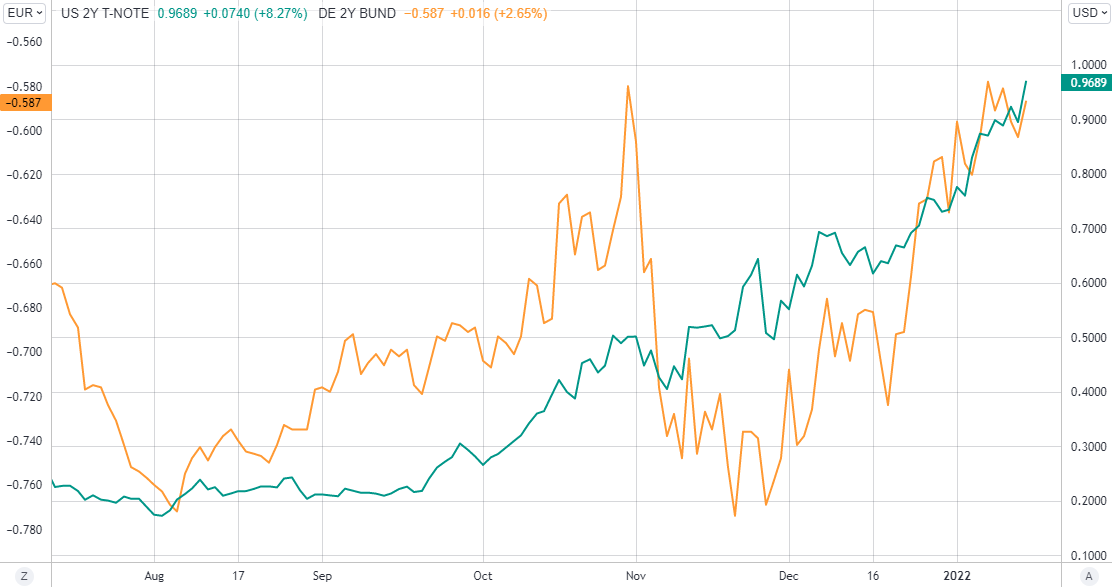

US yields are climbing. So are European yield rates. However, there is still a large gap. Below is the 2-year German yield and the 2-year US yield. As one can see, the German 2-year yield rate is still in negative territory, while the US 2-year yield is getting close to 1%. Both are upwards moving.

Nevertheless, the euro strengthened against the USD last week. MA100 serves as resistance on the upside. Momentum is positive and rising as visualized by MACD.

EUR/USD graph: June 15, 2021, to January 14, 2022

There is strong resistance close to the 1.15 level in the weekly chart of MA200, MA20, and Fibonacci 50.

EUR/USD, weekly five-year price graph

Is there enough energy left for oil to break up?

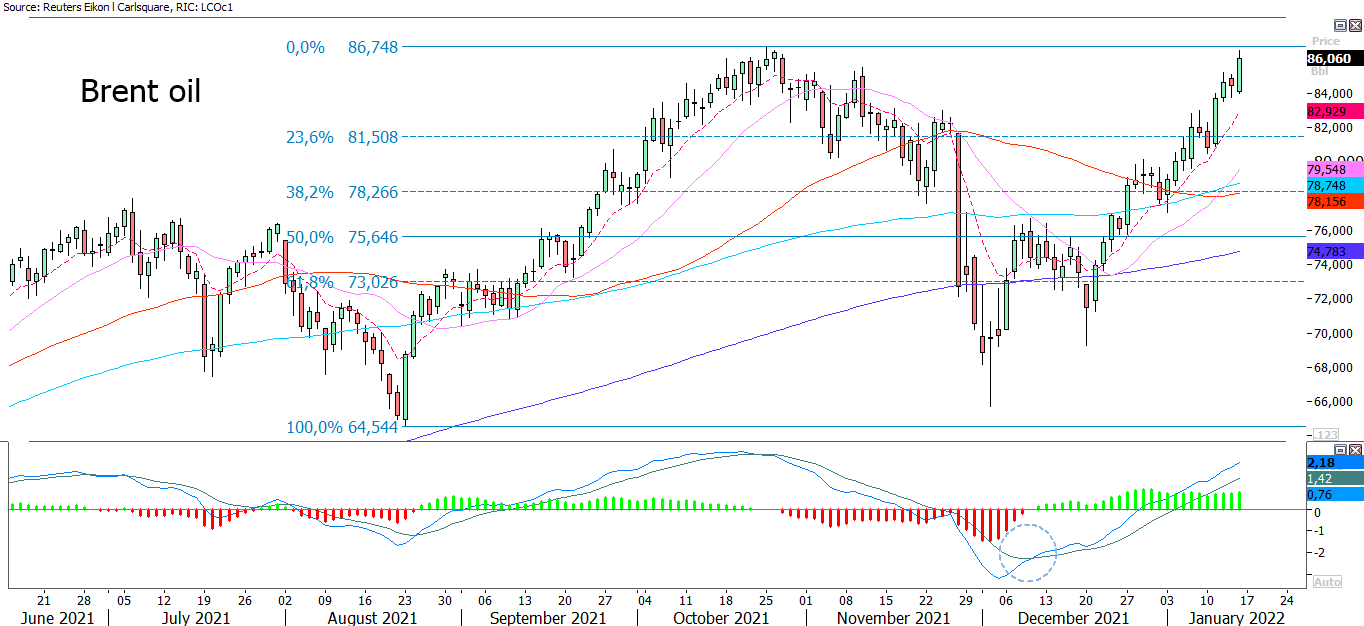

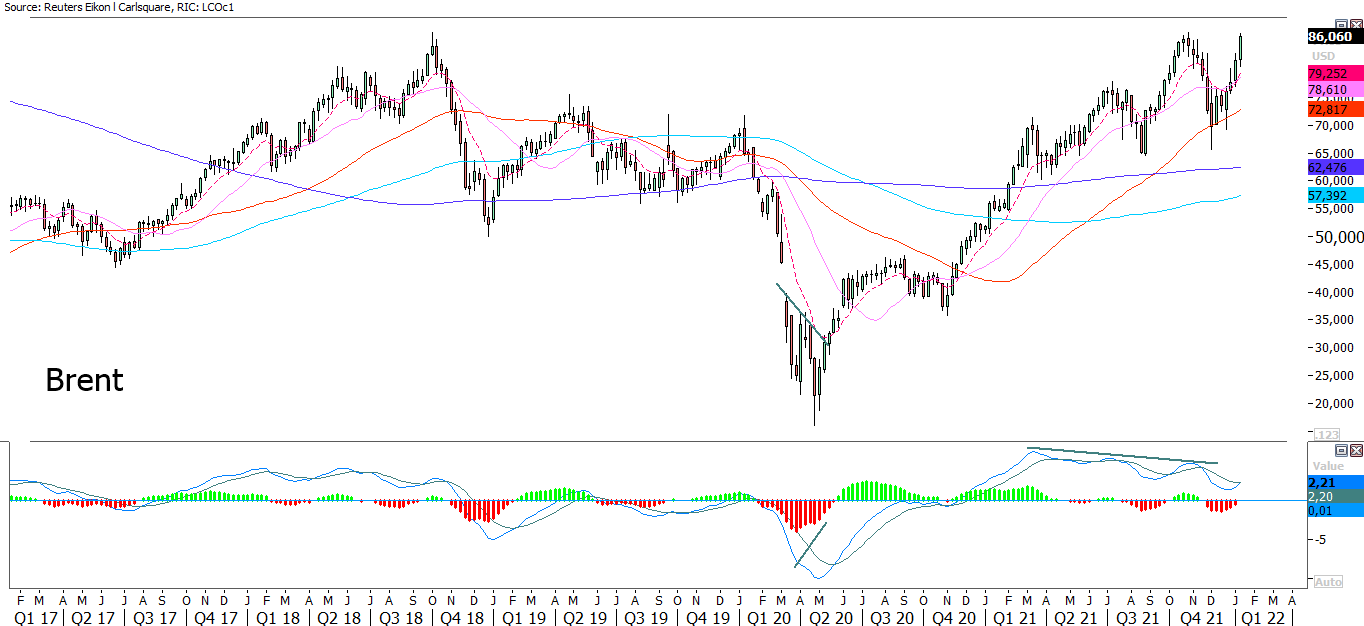

A weaker USD typically supports gold as well as the oil price. The brent oil has also been going strong for various reasons lately. The chart below shows that the oil price is approaching the previous local top from October 2021. Momentum is strong but can it last to break up?

Brent oil price graph: June 15, 2021, to January 14, 2022

Brent oil, weekly five-year price graph

Do rising oil prices ease economic calculations for sustainable energy?

While the oil price is on the move, the opposite is true for the IShares Clean Energy ETF. See the chart below.

One explanation for the large spread is that there has been almost no investment in the oil sector during the last years. In contrast, the opposite has been confirmed for sustainable energy - here, all investors have wanted to enter simultaneously. Various reasons explain this - from subsidies to the fact that it has become part of the policy of many investors and companies to promote sustainable investments. Economic policies such as the EU carbon dioxide goals and taxonomy largely favor sustainable energy sources for the long term. As a higher oil price makes it easier to do favorable economic calculations for renewables, the likelihood of approaching a rebound to the upside for sustainable energy (ETFs, funds, and individual stocks) should be relatively high.

Vontobel has issued an open-end tracker on MSCI World IMI Select Sustainable Impact Top 20 Index. This index has also spread apart from the oil price:

Bull & Bear Certificates

Excellent rebound in S&P 500

The S&P 500 index rebounded upwards early last week. But uncertainty about the impact of rising interest rates continues to plague the market, with a 1.4% price decline on Thursday following hawkish statements from Fed officials. We saw the drop in tech stocks, which is most sensitive to interest rates due to high P/E ratios. The movement in the S&P 500 on Friday, January 14, was then marginally up, plus 0.1%. As shown in the chart below, the index closed well up from its low close to its intraday high, thus ending Friday's trading with an excellent rebound:

S&P 500: June 15, 2021, to January 14, 2022

Last week, five S&P 500 companies reported, including four banks and investment banks. 77 percent of 26 corporate reports among S&P 500 companies registered in December 2021 and January 2022 have surprised with better than anticipated profits. But ahead of the Q4 2021 reports, 56 out of 93 S&P500 companies have issued negative profit warnings.

Earnings results among companies reporting the last weak were consistently better than expected, and stock reactions were primarily positive. One exception was JPM which guided for rising personnel costs from now on.

In the weekly chart, a Doji was created, implying uncertainty.

S&P 500, weekly five-year price graph

Nasdaq's rising trend is under pressure

Nasdaq bounced on Friday after the sharp sell-off on Thursday. MACD is negative and falling, and as interest rates keep on moving upwards, Nasdaq will be under continued pressure to a more significant extent than, e.g., S&P 500.

Nasdaq 100: June 15, 2021, to January 14, 2022

Nasdaq is also trading below EMA9 as well as MA20 in the weekly chart:

Nasdaq 100, weekly five-year price graph

Downside left in Microsoft

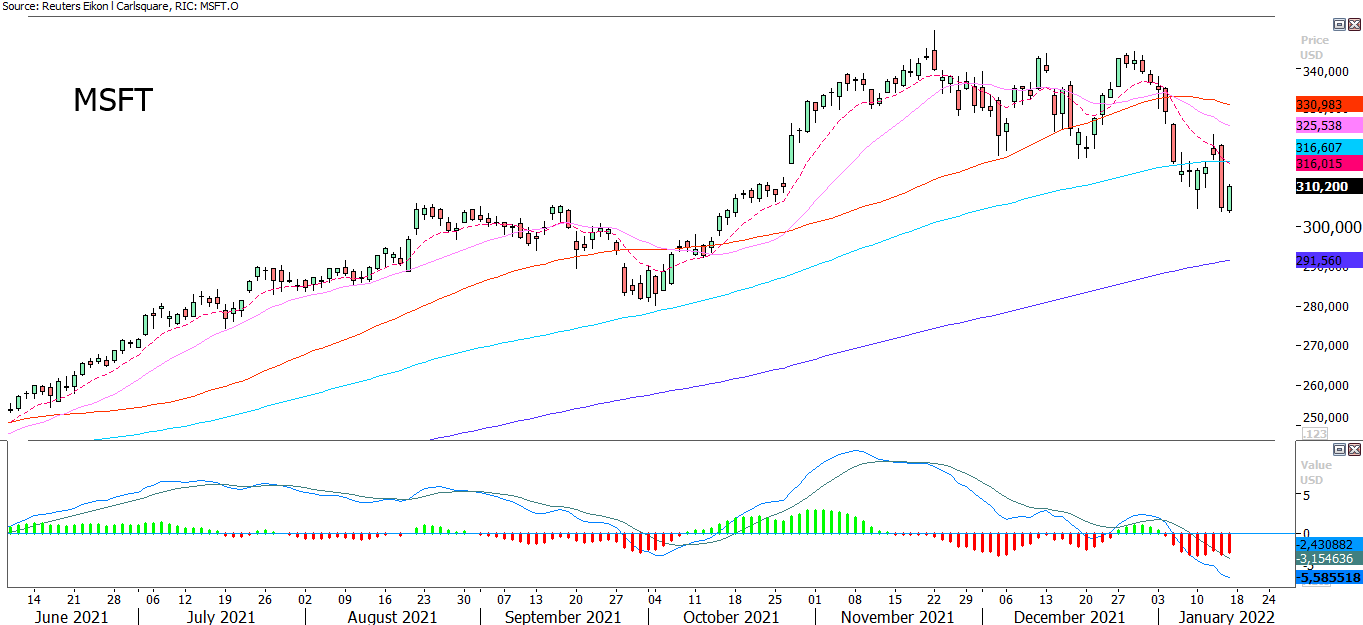

Microsoft is trading under negative momentum below falling EMA9 and MA20. The share is also below MA100. Is MA200 next for the tech giant?

Microsoft share price graph: June 15, 2021, to January 14, 2022

In the weekly chart, Microsoft closed last week below MA20. However, a Doji was created, implying uncertainty of the next move:

Microsoft, weekly five-year share price graph

Historical Schiller P/E-ratio valuation in the light of inflation

Historically, Schiller's P/E ratio has fallen back when inflation rises in the US. It is somewhat worrying that the Schiller P/E ratio was low in the early 1970s. In a time of high oil and gold prices and inflation, we have begun to share similarities with today's situation. In the 1970s, the US 10-year government bond yield ranged between 6.0% and 8.5%, compared to 1.79% today. It justified P/E ratios that were about a quarter of today. Compared to 2000, however, the New York Stock Exchange is significantly lower valued today, as long as the 10-year interest rate remains at 1.79% today, compared to just over 6.5% in the US in the year 2000.

Since 2009 there have been several deflationary waves, out of which Covid was the last one. But it is challenging to identify what will hamper inflation this time. There is no getting away from the fact that central banks hold the keys to ensuring that today's interest rates should not end up significantly higher than they are now. Several analysts are also betting that Fed, after all, will not trigger the rate hike button as many times as what is discounted by the market. A falling stock market has caused the Fed to back down in the past, so why couldn't it repeat now?

Schiller P/E-ratio from January 1, 1950, to January 14, 2022

OMXS30 below MA20

Swedish OMXS30 closed Friday below EMA9 and MA20. The next level on the downside is MA50, close to 2 345. Well worth noticing is that the rebound in New York on Friday was after closing in Europe, meaning there may be some catch-up to do.

OMXS30 price graph: June 15, 2021, to January 14, 2022

In the weekly chart, OMXS closed last week just above EMA9. MA20 makes up a break and the next level at 2 326 (close to MA100 in the daily chart):

OMXS30, weekly five-year price graph

DAX is still holding up

German DAX closed Friday below EMA9, but MA20 is still intact.

DAX price graph: June 15, 2021, to January 14, 2022

In the weekly chart, both EMA9 and MA20 is intact:

DAX, weekly five-year price graph

The full name for abbreviations used in the previous text:

EMA 9: 9-day exponential moving average

Fibonacci: There are several Fibonacci lines used in technical analysis. Fibonacci numbers are a sequence of numbers in which each successive number is the sum of the two previous numbers.

MA20: 20-day moving average

MA50: 50-day moving average

MA100: 100-day moving average

MA200: 200-day moving average

MACD: Moving average convergence divergence

Risks

This information is neither an investment advice nor an investment or investment strategy recommendation, but advertisement. The complete information on the trading products (securities) mentioned herein, in particular the structure and risks associated with an investment, are described in the base prospectus, together with any supplements, as well as the final terms. The base prospectus and final terms constitute the solely binding sales documents for the securities and are available under the product links. It is recommended that potential investors read these documents before making any investment decision. The documents and the key information document are published on the website of the issuer, Vontobel Financial Products GmbH, Bockenheimer Landstrasse 24, 60323 Frankfurt am Main, Germany, on prospectus.vontobel.com and are available from the issuer free of charge. The approval of the prospectus should not be understood as an endorsement of the securities. The securities are products that are not simple and may be difficult to understand. This information includes or relates to figures of past performance. Past performance is not a reliable indicator of future performance.