The market is booming, regardless of president - Good potential upside in bitcoin

For us, it is quite certain that an election victory for President Trump should be better for the US stock markets than a victory for Biden. Despite all concern about the opposite, Trump has not started any wars and he has lowered taxes overall. It is more often Democrats who start wars and raise taxes.

For us, it is quite certain that an election victory for President Trump should be better for the US stock markets than a victory for Biden. Despite all concern about the opposite, Trump has not started any wars and he has lowered taxes overall. It is more often Democrats who start wars and raise taxes.

Can it have the same effect as they used to say in Sweden. “If the Social Democrats win, the stock market will back down one day and then rise for three years. If the Swedish conservative and liberal alliance wins, the stock market rises one day and then back down for three years?”

The biggest downside remains that President Trump does not accept the election result but appeals to the Supreme Court.

The relatively few S&P 500 companies that have so far reported their Q3 figures have surprised positively to a 91 percent degree when it comes to profits.

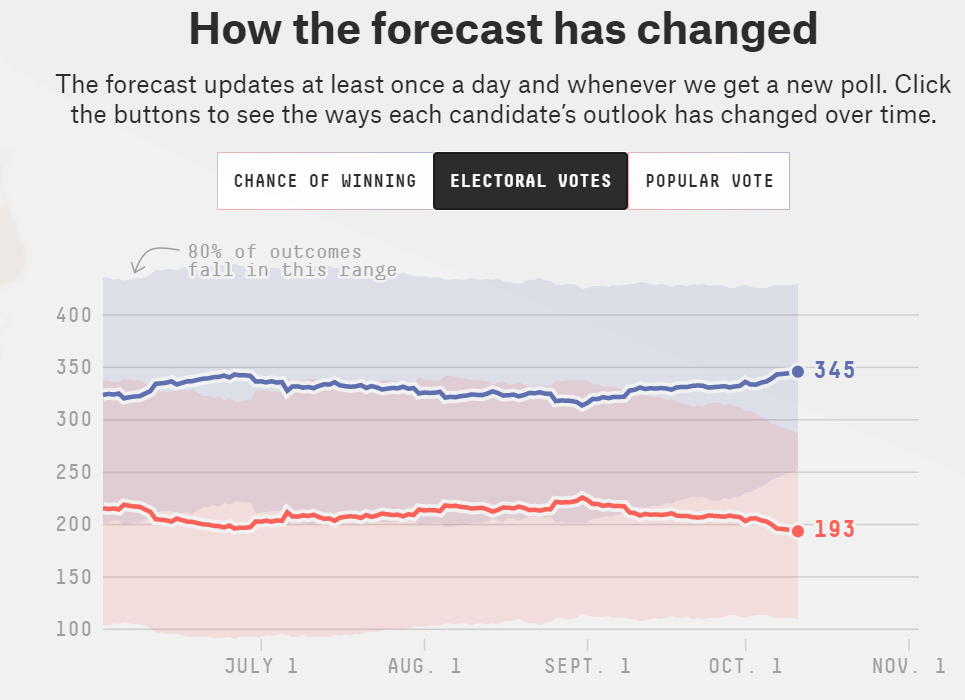

In the recent opinion polls ahead of the US presidential election, Biden´s lead is growing.

The above picture is from: https://www.pewresearch.org/politics/2020/10/09/the-trump-biden-presidential-contest/

It shows that it is relatively even between the core voters but a lead for Biden among those who are more mobile. The gap between the candidates is apparently so large that even Trump should admit an election loss, you might think.

https://projects.fivethirtyeight.com/2020-election-forecast/

In addition, Biden has wind in its sails. The fact that President Trump fell ill in Covid 19 was really a setback.

The problem (if it is a problem) is that in the last presidential election, Trump had even lower turnout at the same time he has in this election. The opinion polls seem to be losing in quality and people seem to be voting tactics more and more. This at least in our eyes seems to give more and more even elections. Trump never led the polls against Hillary Clinton.

On election day 2016, Clinton had 48 percent of the votes and Trump 46 percent. Hillary won the election by 2.87 million votes if you count the entire United States. But Trump won in the important swing states and got 304 electoral votes against 227 for Clinton.

If you look at how VIX is traded, the uncertainty in the market is great. This probably does not show the choice of candidate, but rather the concern that it will be messy after the election.

Trump is hit hard by the fact that he is unable to reach an agreement with the Democrats on a Support package. In the US equivalent of the Debt Office, there was USD 400 billion in March, which has now risen to USD 1.7 trillion- cash just waiting to be spent.

The stock market expects that regardless of the winner, large support packages will appear. The risk lies in the fact that it will be the US Supreme Court that may choose the winner if the losing side appeals the election result. This have a relative high probability given previous election results and the US heavily criticized electoral system.

It is thus enough that we get a clear winner for continued stock market rise.

Following that, we are more inquisitive about the stock market. Biden waves happily with large tax increases, especially on capital gains. The large investment banks also conclude that this may be negative on the stock exchange in 2021. This is especially true in the fourth quarter of 2021 before a tax increase which then take effect on 1 January 2022. It is above all the shares that have performed the strongest until then that will be exposed to a selling pressure. Given the development of the past year, it is not difficult to guess where the sell programs will work:

The Q3 reporting season

When 22 of 503 S&P companies after one month (September 10-October 9) have reported their Q3 figures, 91 percent have surprised positively on the profit line and 86 percent in terms of revenue. As we mentioned already last week, it really hits this week with mainly Q3 reports from the major US banks. On the other hand, the proportion of companies where the forecasts are revised over the next 30 days has increased among those that has been received so far in October. But it is still 73 percent of the companies where the forecasts are instead revised upwards. Just like on the Stockholm Stock Exchange (where there have been several reversed profit warnings in the past weeks), it looks good so far in terms of company reports in the US.

Momentum – Good potential upside in Bitcoin

Tech and consumer goods are winners while energy companies and finance are losers, seen in the last 200 trading days.

It is still important to keep an eye on the graphs.

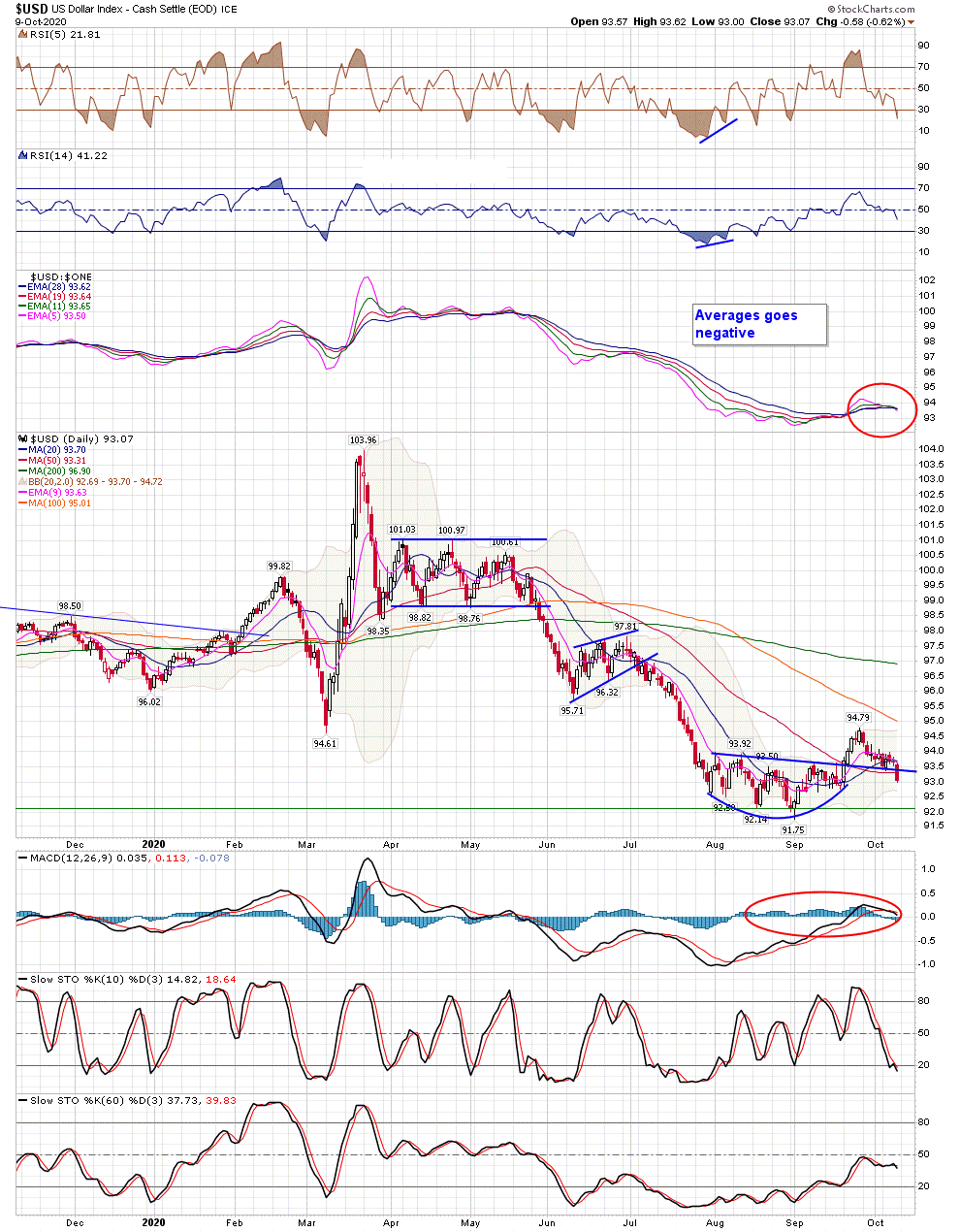

Last Thursday-Friday, two important events occurred.

The US dollar-index broke down below the important guideline and it happened properly! Note that the MACD also generated a weak sell signal and the moving averages break each other. All this signals that the market anticipates that large support packages will soon be delivered. What is bad for the underlying economy is now good for the stock market!

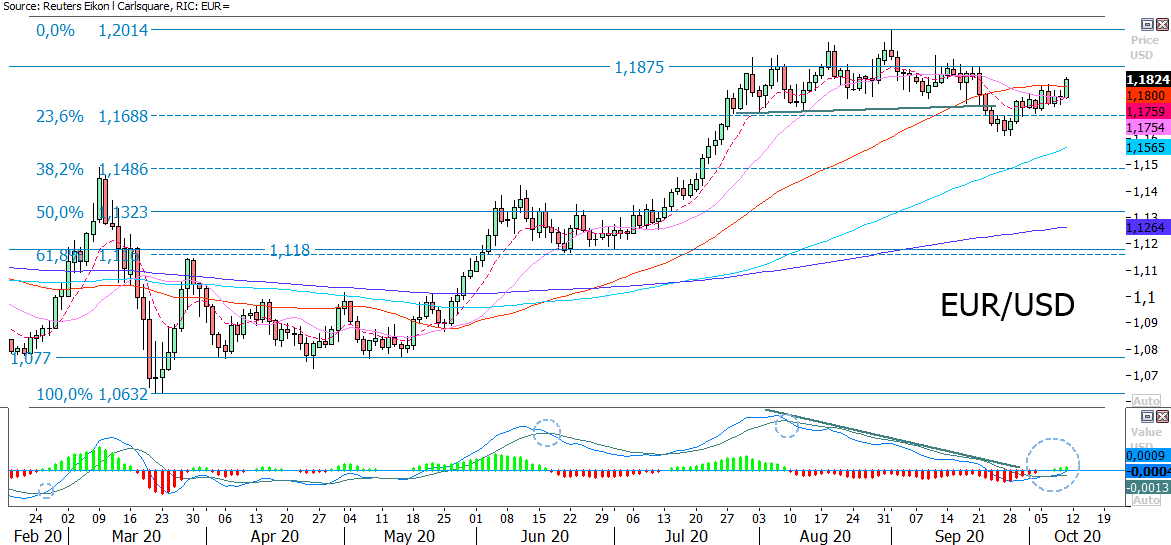

EUR/USD has been on the rise and the currency pair managed to close above MA50 on Friday. Also note how MACD has generated a weak buy-signal close to the zero-line. The next level on the upside can be found around 1.1875:

The other significant event is that the S&P 500 broke above the neckline of what can be viewed as an inverted head and shoulder formation. Frankly speaking, the focus is now on the previous peak. For bears, however, the battle is not lost. If the previous peak is not broken, then by definition a lower peak is created, which for the long trend is negative. But with that said, the stock market has suddenly turned into a positive trend, with weathering on new fresh support billions.

The main remaining uncertainty for the stock market is when the presidential election will be interpreted as appealed? Otherwise it is full throttle that counts.

The stock market rise is confirmed by the junk bond market. Note that this has now risen steadily for two weeks and touches all-time-high!

The FANG company stocks continue to perform strong. Note that in the individual FANG companies, the trend is challenged at regular intervals. But for the FANG group as a whole, the conviction of a continued rise is great, which shows that they are changing gears. This should be exploited by skilled traders.

Amazon closed above MA50. The next level can be found around 3 323 USD. MACD has generated a buy-signal and the previous top may soon come into play:

The Apple share is now wrestling with resistance in form of Fibonacci 23.6. The next level can be found around 121 USD. Also note that MACD has generated a buy signal:

Swedish OMXS30 is struggling to break up above the 1 850-level. The index is supported by a rising EMA9 and MA20. In case of a break to the upside, the previous top around 1 900 can be put into play.

The German DAX is also trading above its moving averages. Will the gap be closed this time?

As all commodites, gold is a winner on a falling USD. Note that MACD has generated a buy signal. Gold now wrestles with Fibonacci 23.6 and MA50. In case of a break to the upside, the next obvious level can be found around 1 972,75 USD per troy ounce:

Bitcoin also rises on a falling USD and has broken up from a neutral wedge-formation. MACD has generated a buy-signal. The formation calls for further upside, above the previous top from September:

Risici

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.